Leasehold Reform - zero ground rent extension

Leasehold Reform – ability to extend property leases at zero ground rent

Those who own leasehold properties will now be able to extend their lease by up to 990 years and pay no ground rent.

The government has introduced new legislation in response to public outcry on how ground rent was negotiated. Some houses and flats were sold with a clause that meant ground rents could rise sharply over the years. Around 4.5m homeowners in England and Wales own their homes on a leasehold basis but not all are expected to be affected by the policy reform. Discover the difference between a leasehold and a freehold here.

Currently, the lease period of a house can be extended by 50 years plus the existing lease period. However, the leasehold house owner has the right to buy the freehold and may choose to do that in most instances. Although, extending the lease is more affordable. The majority of houses are sold as freehold, whereas apartments are typically sold as a leaseholder title.

The leaseholder will pay a ground rent which was historically less than £250 per annum or a peppercorn rent. In recent years developers have been selling leasehold titles with ground rents that double every 10 years. This has led to some homeowners being unable to move and saddled with hefty rent to pay and an unmortgageable home. Further leasehold reform is set to put an end to that but in the meantime the ground rent reform is being seen as a significant win for leaseholder.

What do the leasehold reforms mean?

What ground rent reform means in practical terms is that leasehold owners of apartments will be placed on an even keel. Leaseholders will be able to extend their leasehold title to 990 years and not have to pay any ground rent thereafter.

Under recommendation from the Law Commission, those who own flats or houses under a leasehold contract will be able to extend it to up to 990 years with ground rent at zero. Additionally, all retirement properties will be sold without ground rent. The cost of extending a leasehold will also be reviewed, and proposals to outlaw “marriage value” charges in which a leaseholder must share profits deriving from an extension with the freeholder will be considered.

The leasehold reform will only affect England and Wales, as property in Scotland is owned on a freehold basis and in Northern Ireland ground rent is redeemable. For investors, owning the freehold may help boost rental yields, and it is part of the reason why Scottish investment property in cities such as Edinburgh is so coveted.

One opportunity to invest is 53 George St. Located within Edinburgh's New Town, it is within walking distance of Edinburgh Waverley Railway Station, Edinburgh's financial centre and Edinburgh Castle. A large two-bedroom apartment can be purchased for £460,000, and due to its ideal location; it could make a good serviced apartment investment. The apportioned communal running cost as George street is very low at £362 per annum so investors can maximise rental yields.

According to Statistica, Edinburgh is the UK’s second most visited city for overseas visitors in the UK. In 2019, it recorded 5.3 million overnight trips, and with so many attractions and festivals it is not hard to see why. In 2019 over 2.6 million people visited Edinburgh’s Christmas Market, and over 3 million tickets were bought for Edinburgh’s Fringe Festival in the summer of 2019. Attractions, festivals, and markets are open year-round meaning there is minimal seasonal downturn.

Download our free buy-to-let guide today to discover more about reforms to the UK property market.

For those looking at property investment with low ground rents, another opportunity is Icona in York. Ground rent per annum is 0.1% of the sales price. With apartments starting from £255,000, this works out as ground rent amount to £255 per annum which is very reasonable. The development is a 9-minute walk from York’s city centre and onsite facilities include a residents’ gym, rooftop terrace and concierge service. Apartments can be rented as serviced apartments and due to the development’s location and services, yields of over 7% are projected.

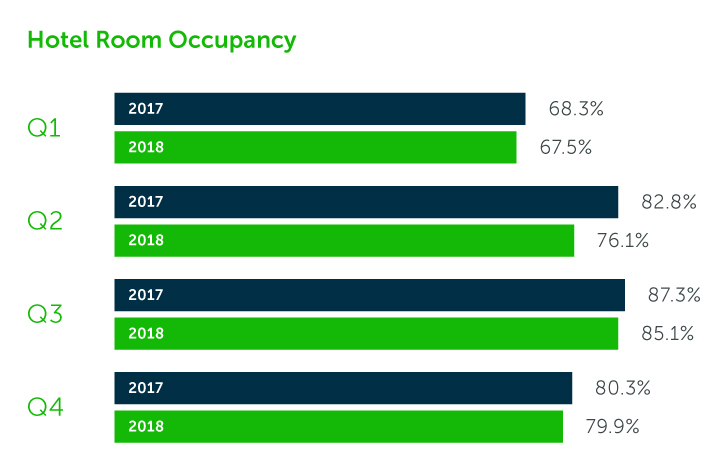

York is an excellent place for service accommodation with nearly 80% hotel occupancy in 2018 and 8.4 million visitors annually (mostly UK domestic). There certainly are good fundamentals and the apartments can be fully managed by an airbnb specialist taking the hassle away from the investor.

This ground rent reform is good news. It certainly makes sense to keep ground rent costs down as it increases net yield. Focussing on properties like George Street and Icona with low running cost is NB. It is projected that further improvements will be made to the leasehold reform act. Sign up to our property investor news to get the latest info to make better investment decisions.

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!